There were two gay couples with identical financial resources. They each had the same amount of money, identical investments, identical taxes, and identical earnings history for Social Security purposes.

The first couple did no planning. The second gay couple followed the advice offered in Live Gay, Retire Rich! Doing reasonable projections, the first couple runs out of money in 28 years while the second couple has $1.4 million dollars and their portfolio continues to increase.

What was the difference? The first couple never got married, started Social Security at 62, didn’t make any Roth IRA conversions, and didn’t use key IRA, retirement plan and estate planning strategies. The second gay couple did get married, used our recommended apply and suspend technique for Social Security, did a series of Roth IRA conversions, and used key IRA, retirement plan and estate planning strategies.

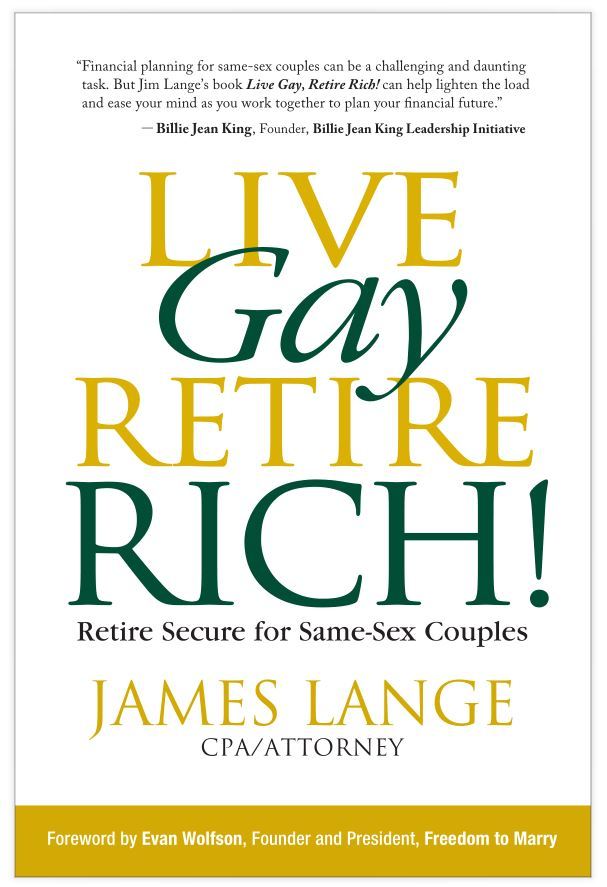

Live Gay, Retire Rich! gives same-sex couples the knowledge they need to get their retirement right!

James Lange, CPA

Jim is a nationally-recognized tax, retirement and estate planning CPA with a thriving registered investment advisory practice in Pittsburgh, Pennsylvania. He is the President and Founder of The Roth IRA Institute™ and the bestselling author of Retire Secure! Pay Taxes Later (first and second editions) and The Roth Revolution: Pay Taxes Once and Never Again. He offers well-researched, time-tested recommendations focusing on the unique needs of individuals with appreciable assets in their IRAs and 401(k) plans. His plans include tax-savvy advice, and intricate beneficiary designations for IRAs and other retirement plans. Jim’s advice and recommendations have received national attention from syndicated columnist Jane Bryant Quinn, his recommendations frequently appear in The Wall Street Journal, and his articles have been published in Financial Planning, Kiplinger’s Retirement Reports and The Tax Adviser (AICPA). Both of Jim’s books have been acclaimed by over 60 industry experts including Charles Schwab, Roger Ibbotson, Natalie Choate, Ed Slott, and Bob Keebler.